4 Best Couple Finance Apps Top Picks for Financial Harmony

Explore the best couple of finance apps to manage joint finances effortlessly. Learn about key features, and choose the best app for you and your partner.

Why You Need the Best Couple Finance App

Managing finances as a couple can be challenging, but with the best couple finance app, it becomes more straightforward. Whether you are newlyweds, long-term partners, or just starting your financial journey together, having a reliable finance app can make budgeting, saving, and tracking expenses seamless.

Key Features to Look for in a Best Couple Finance App

When choosing the best couple finance app, there are several essential features to keep in mind:

⦁ Joint Budgeting: The ability to plan and maintain a joint budget is crucial.

⦁ Expense Tracking: Easy tracking and categorization of expenses.

⦁ Bill Splitting: Convenient ways to split and settle bills.

⦁ Savings Goals: Tools to set and track savings goals.

⦁ Financial Insights: Reports and analytics to understand spending habits.

⦁ Security: Strong security measures to protect sensitive financial data.

Top 4 Couple Finance Apps to Consider

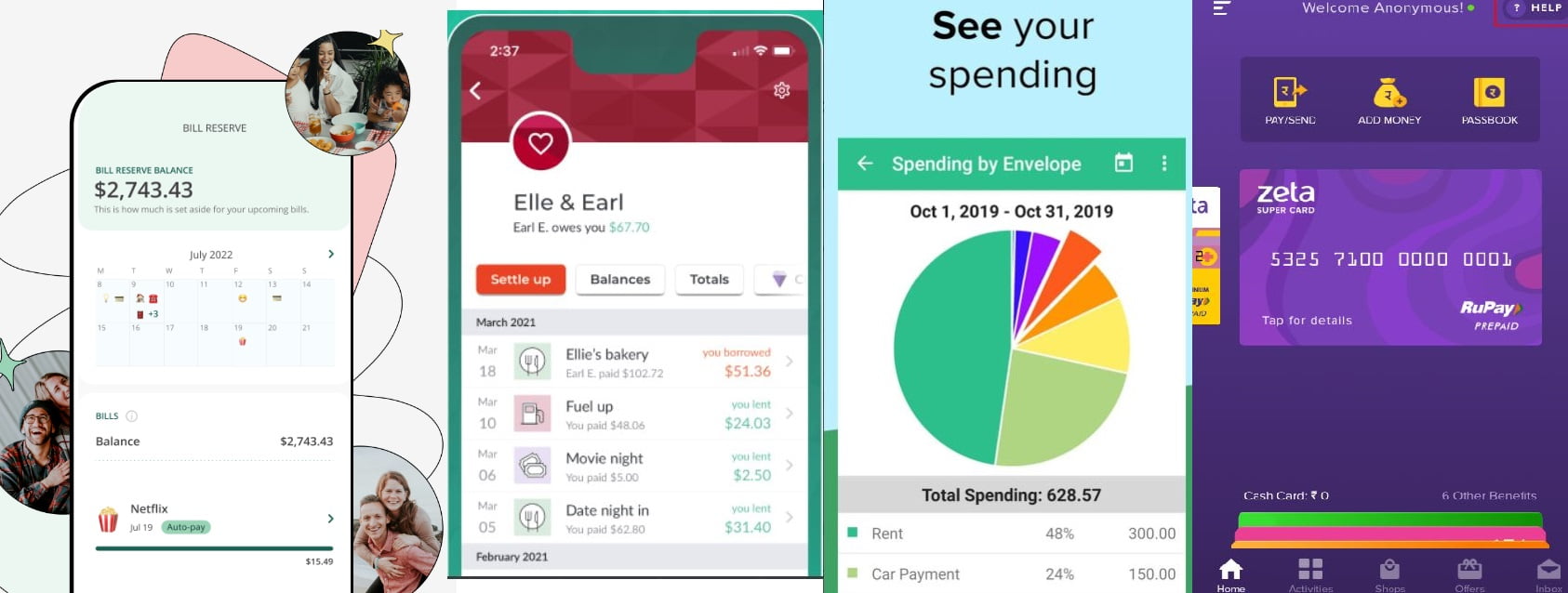

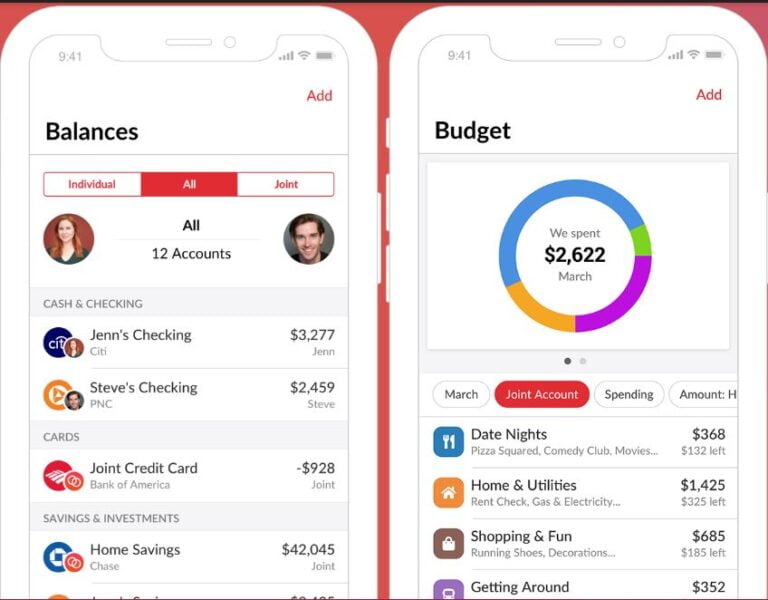

Honeydue is widely considered one of the best couple finance apps.

- It offers:↓

- Joint Budgeting: Create and manage a budget together.

- Expense Tracking: Automatically categorise and track expenses.

- Bill Reminders: Notifications to remind you of upcoming bills.

- Account Syncing: Synchronise multiple bank accounts and credit cards.

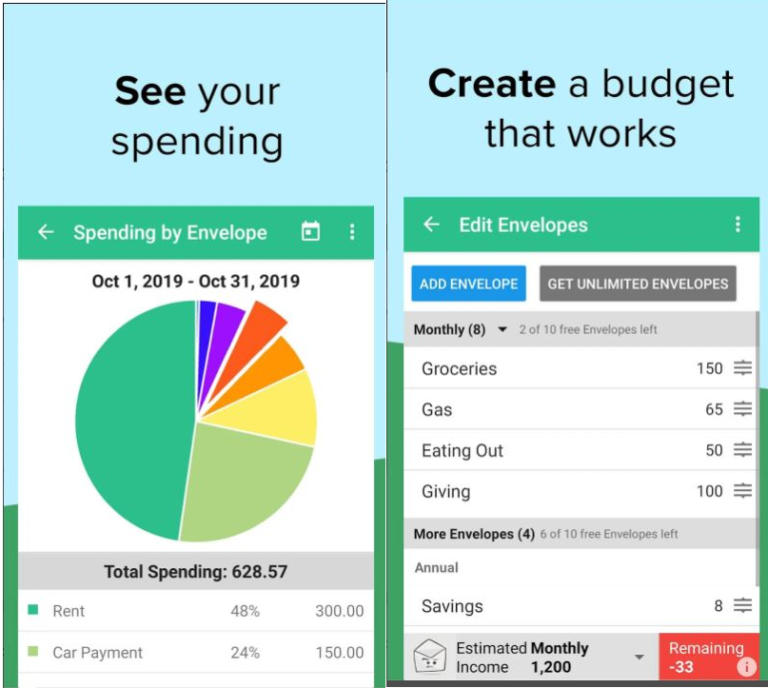

Goodbudget is another excellent choice for couples looking to manage their finances together. It includes:↓

⦁ Envelope Budgeting: Use the envelope budgeting system to allocate funds.

⦁ Expense Tracking: Track spending and stay within budget.

⦁ Debt Management: Tools to help with debt repayment plans.

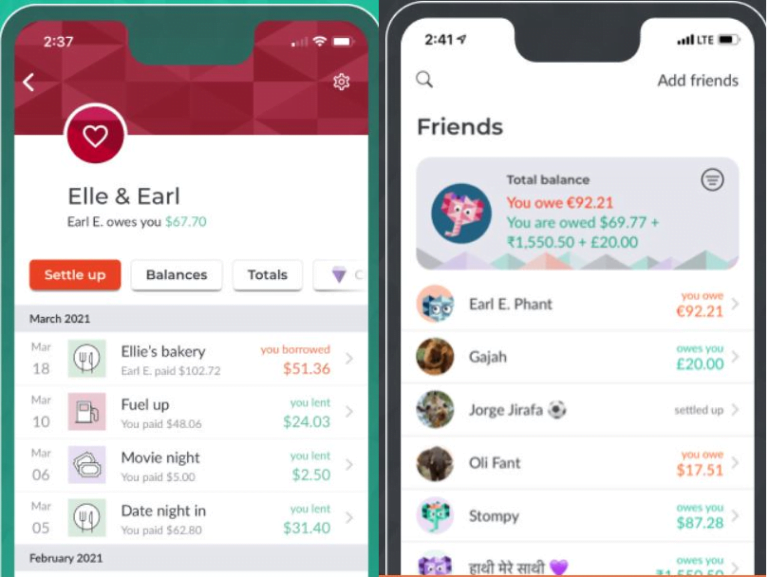

Splitwise excels in simplifying the process of splitting expenses, making it ideal for couples sharing costs. Features include:↓

⦁ Bill Splitting: Easily split and settle shared bills.

⦁ Expense Tracking: Track who owes whom and settle balances.

⦁ Recurring Expenses: Manage repeating expenses like rent or utilities.

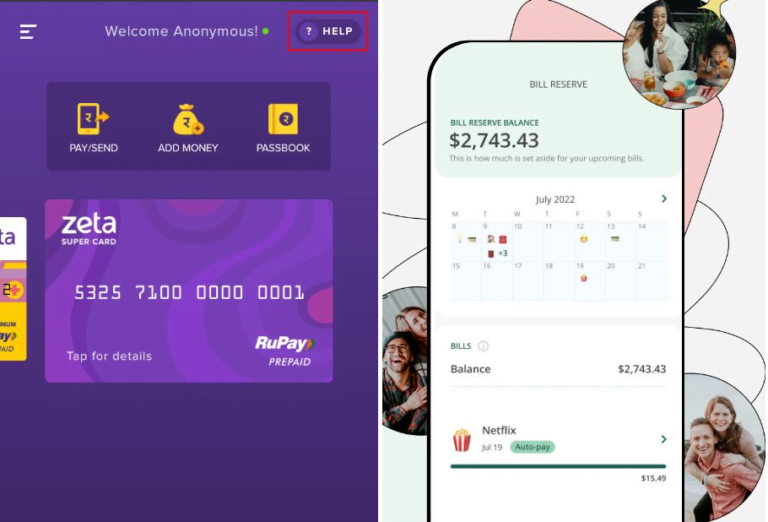

Zeta is designed specifically for couples, offering a comprehensive suite of features:↓

⦁ Joint Budgeting: Create joint budgets and track progress.

⦁ Account Syncing: Link bank accounts, credit cards, and loans.

⦁ Expense Sharing: Track and share expenses effortlessly.

⦁ Financial Planning: Set and achieve shared financial goals.

How to Choose the Best Couple Finance App for You

Choosing the best couple finance app depends on your unique financial situation and needs. Here are some tips to help you decide:

⦁ Identify Your Needs: Determine what features are most important to you, such as joint budgeting, expense tracking, or bill splitting.

⦁ Read Reviews: Check user reviews to understand the experiences of other couples.

⦁ Test the App: Most apps offer free trials or basic versions, so test a few to see which works best.

⦁ Consider Security: Ensure the app uses robust security measures to protect your financial information.

Tips for Successfully Managing Finances as a Couple

Using a finance app is just one part of managing money effectively as a couple. Here are additional tips:

⦁ Communicate Regularly: Discuss financial goals, expenses, and challenges frequently.

⦁ Set Financial Goals: Agree on short-term and long-term financial goals.

⦁ Be Transparent: Maintain openness about spending habits and financial commitments.

⦁ Review and Adjust: Regularly review your budget and adjust as needed.

Conclusion & Engagement

In conclusion, finding the best couple finance app can make managing joint finances easier and more efficient. Whether you choose Honeydue, Goodbudget, Splitwise, or Zeta, the right app can help you achieve financial harmony.

Have you tried any of these apps, or do you have a different favorite? Let us know in the comments below. Don’t forget to share this post with your partner to start your financial journey together!

Your article holds considerable promise, showcasing insightful ideas and a solid foundation. To elevate it to a truly outstanding level, consider the following enhancements: Deepen your analysis by exploring key concepts more thoroughly, providing nuanced explanations, and addressing potential counterarguments. Strengthen your arguments with additional evidence, including peer-reviewed sources, relevant statistics, and illustrative case studies. Refine your writing style to engage advanced readers by varying sentence structures, employing more sophisticated vocabulary, and ensuring each paragraph flows seamlessly into the next. Enhance the overall narrative arc by crafting a more compelling introduction that clearly outlines your thesis and a conclusion that reinforces your key points while highlighting broader implications. Incorporate a more critical examination of alternative viewpoints to demonstrate a comprehensive understanding of the topic and preemptively address potential critiques. Elaborate on the practical implications and real-world applications of your arguments to increase the relevance and impact of your work. Draw connections to related fields or concepts, broadening the scope and appeal of your article while showcasing its interdisciplinary significance. Consider incorporating more vivid examples or analogies to illustrate complex ideas, making your work more accessible without sacrificing depth. If appropriate, include visual elements such as graphs, charts, or infographics to support your textual arguments and appeal to visual learners. Ensure your conclusion not only summarizes your main points but also opens up avenues for further research or discussion, encouraging ongoing engagement with your ideas. Your innovative approach and clear writing provide an excellent foundation, and by implementing these suggestions, you can transform your already solid work into an exceptional piece that resonates deeply with a professional audience and makes a significant contribution to your field. The potential for greatness in your work is evident. Your commitment to excellence shines through, and I’m confident that your continued efforts and refinements will yield truly impressive results. I eagerly anticipate seeing how you build upon these strengths in your future endeavors, further establishing yourself as a thought leader in your area of expertise.

Your article holds considerable promise, showcasing insightful ideas and a solid foundation. To elevate it to a truly outstanding level, consider the following enhancements: Deepen your analysis by exploring key concepts more thoroughly, providing nuanced explanations, and addressing potential counterarguments. Strengthen your arguments with additional evidence, including peer-reviewed sources, relevant statistics, and illustrative case studies. Refine your writing style to engage advanced readers by varying sentence structures, employing more sophisticated vocabulary, and ensuring each paragraph flows seamlessly into the next. Enhance the overall narrative arc by crafting a more compelling introduction that clearly outlines your thesis and a conclusion that reinforces your key points while highlighting broader implications. Incorporate a more critical examination of alternative viewpoints to demonstrate a comprehensive understanding of the topic and preemptively address potential critiques. Elaborate on the practical implications and real-world applications of your arguments to increase the relevance and impact of your work. Draw connections to related fields or concepts, broadening the scope and appeal of your article while showcasing its interdisciplinary significance. Consider incorporating more vivid examples or analogies to illustrate complex ideas, making your work more accessible without sacrificing depth. If appropriate, include visual elements such as graphs, charts, or infographics to support your textual arguments and appeal to visual learners. Ensure your conclusion not only summarizes your main points but also opens up avenues for further research or discussion, encouraging ongoing engagement with your ideas. Your innovative approach and clear writing provide an excellent foundation, and by implementing these suggestions, you can transform your already solid work into an exceptional piece that resonates deeply with a professional audience and makes a significant contribution to your field. The potential for greatness in your work is evident. Your commitment to excellence shines through, and I’m confident that your continued efforts and refinements will yield truly impressive results. I eagerly anticipate seeing how you build upon these strengths in your future endeavors, further establishing yourself as a thought leader in your area of expertise.